Many cities and regions around the country face a concerning difference in cost of living and income level, state minimum wage, average household income, etc. Before the pandemic, small towns were steadily growing. Small towns offer affordable housing, lower expenses, open spaces, safer and family-friendly communities.

The pandemic accelerated the move to smaller towns as people sought to get out of cramped areas quickly. As the pandemic wanes, many Americans are deciding to stay in smaller towns.

Rising Rates and Lower Wages

According to a 2020 survey, 47 percent of Americans said that the cost of living was the biggest threat to their financial security. The survey also found that 44 percent of Americans fear the rising cost of healthcare. On average, Americans spend about $5,000 a year on out-of-pocket health care costs. The out-of-pocket expenses include insurance, prescriptions, and medical supplies.

Since the lows of the 2008 Depression, the U.S. economy has been steadily growing. But the pandemic saw the specter of inflation hovering over the U.S. economy. Due to supply shocks, labor shortages, and stimulus spending, prices rose faster than anticipated. With the growing economy and prices were also steadily increasing.

According to the Bureau of Labor Statistics’ Consumer Price Index, the cost of living increased by 7.9 percent. Food and energy costs were the biggest inflation drivers.

The post-pandemic job growth is robust, and the unemployment rate has fallen to 3.6 percent, near its pre-pandemic low. Wage growth increased by 5.6 percent from a year ago. Although job and wage growth is welcome news, high inflation hampers it.

Large states like New York, California, and Florida are experiencing some of the highest rises in living costs. While Mississippi, Arkansas, and Iowa have slower price increases than the national average.

In North Carolina, there is rapidly climbing cost of living issues for previous and new residents alike. The Holly Springs area is one of the booming cities. Holly Springs attracts families because of the high quality of life it offers. Reputable services that families require, like dentists, are available and convenient to access. It is important to include essentials like a Holly Springs dentist and a family doctor in your living expenses budget.

Affording the Unaffordable

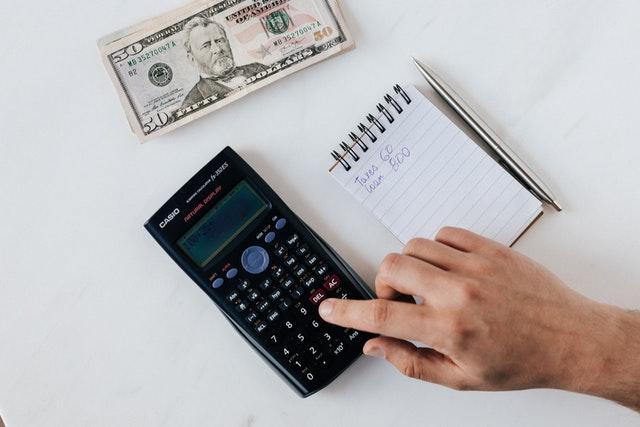

A budget is essential in any financial planning activity. It helps you understand your expenses and how you can manage them. It also shows you where your money comes from and how you can make savings. If you don’t keep a budget, now is the time to start one.

Food normally takes up 10 percent of most household budgets. For example, fruits and vegetables have low increases while meat has substantive increases. You can maneuver your meals around the foods with no or low price increases to save money. Additionally, you can take advantage of any coupons, deals, or sales your supermarket offers. If things get tough, you may use food stamps recently increased to $36 per recipient; that means a family of four can get $144 in benefits.

Heating oil, natural gas, and other fuels are some of the most significant contributors to inflation; sadly, they are more likely to continue going up. If you are struggling with the heating bill or have to commute daily, the energy price inflation can be stressful.

To reduce your transport costs, you could ask your employer to work remotely full-time or part-time; if you can’t work remotely, you will have to consider using public transport or carpooling. If you are struggling with the energy bill, you could use the Low Income Home Energy Assistance Program (LIHEAP) and the Weatherization Assistance Program (WAP). These are federal programs that help low-income households with energy bills.

Car and car part manufacturers were part of the industries affected by the global supply shortages, which led to price increases. You may be looking to buy a new or used car. But if you can wait to make the purchase, you may find lower prices in the future. If you are planning to make significant repairs or replacements to your car, you should also wait. As manufacturing picks up, prices for new cars, used vehicles, and parts will decrease. So for as long as it’s not an emergency, wait on any major car decisions.

Take Charge of Your Finances

Life is getting more expensive across all measures and regions. Don’t be a victim of circumstances. Take charge of your finances and escape the inflation trap. Take advantage of any government assistance, change your spending habits, and budget your money.

![Daily Bite [Make]: Philly Cheesesteak Stuffed Bell Peppers](https://dashofwellness.com/wp-content/uploads/2013/01/Philly-Cheesesteak-Stuffed-Pepper-Daily-Bite-1-100x70.png)